The HFM Response to the Cost of Living Crisis

About our EconomoLogical Approach

-

At Hoole Food Market

-

About our EconomoLogical Approach - At Hoole Food Market -

Over the last few months, you’ve probably noticed that the UK media have focussed on the Cost of Living Crisis, and I’ve keenly followed many of the stories in all forms of news media. But must admit to being a little perplexed by some of the reporting.

I’ve seen some really good points made by politicians of all stripes, but made really badly. But I’ve also noticed that all of the reporting is based on supermarket prices.

Fuel is indisputable. Anyone who has to use any form of internal combustion engine will know how immediately their finances were impacted after the dreadful actions of Russia in Ukraine.

Food on the other hand, or certainly the type of food that we procure and purvey seems far more stable than the media would have you believe.

After reading an article at the weekend which reported a 21.4% price rise for own label Closed Cup Mushrooms from one of the more price focussed supermarkets, ASDA to be precise, I decided to do some analysis of our own prices. It was this headline about mushrooms that piqued my interest as Closed Cup Mushrooms have been one of the most stable prices in the fresh produce market.

So why the increase of more than one fifth? A question only the pricing strategist at ASDA can provide presumably, but I’ll attempt to guess some of the reasons below.

The HFM pricing strategy is and always has been based on fresh wholesale market prices. So if there’s a fall in the wholesale price, we pass the saving on immediately. Conversely, if the price rises we also pass the extra cost on - this is how we try to maintain a fair and balanced approach to everyone we work with, whether a Market Gardener, Farmer, Wholesaler, Importer at the supply end. Or a Retail Customer, Website Customer or Wholesale Customer at the other end.

I’ve been monitoring our input and sale prices on a daily basis, as I always have. But I haven’t really noticed any unattributable price rises over the last few months. There have been a few short-term price rises due to import problems and reduced harvest yields for Spanish salad items such as Tomatoes and Iceberg Lettuce - I’m sure everyone read the headlines about McDonald’s having to ration Tomatoes on their burgers and large food retailers having images of tomatoes on sale, but no physical stock!

I was starting to see a rise in the average spend per customer in April. But this has since reduced back to the expected level. This can be explained by the occurrence of Mothering Sunday and the increased sales of Plants and Flowers associated with such an event.

So, I was left looking at the various forms of data that my plethora of spreadsheets capture and wondering how I could best track any volatility in our prices.

Luckily, I keep a record of our prices, split into produce categories with a weekly snapshot of all prices per unit available via our website. These are all standardised unit quantities, which make averages less subject to extremes, compared to if we were to use a price per kilogram figure. This measure has been consistently recorded every Saturday for the last couple of years, so I set about plotting this data on a chart, which I find is easier to analyse. This isn’t a perfect measure for fresh produce inflation as there are certain higher value items of produce which are only available at specific times of the year. However, as an indication of overall prices it ought to be satisfactory.

I was surprised to find that expressed in this way our average price per unit is lower now than it was at the beginning of January. In the image below our prices had been steadily falling since week 16, and the only reasons for the rise in week 22 was that the Cheshire Potatoes had arrived, which are on of the previously mentioned higher value seasonal items of produce, and Melon import costs were rising.

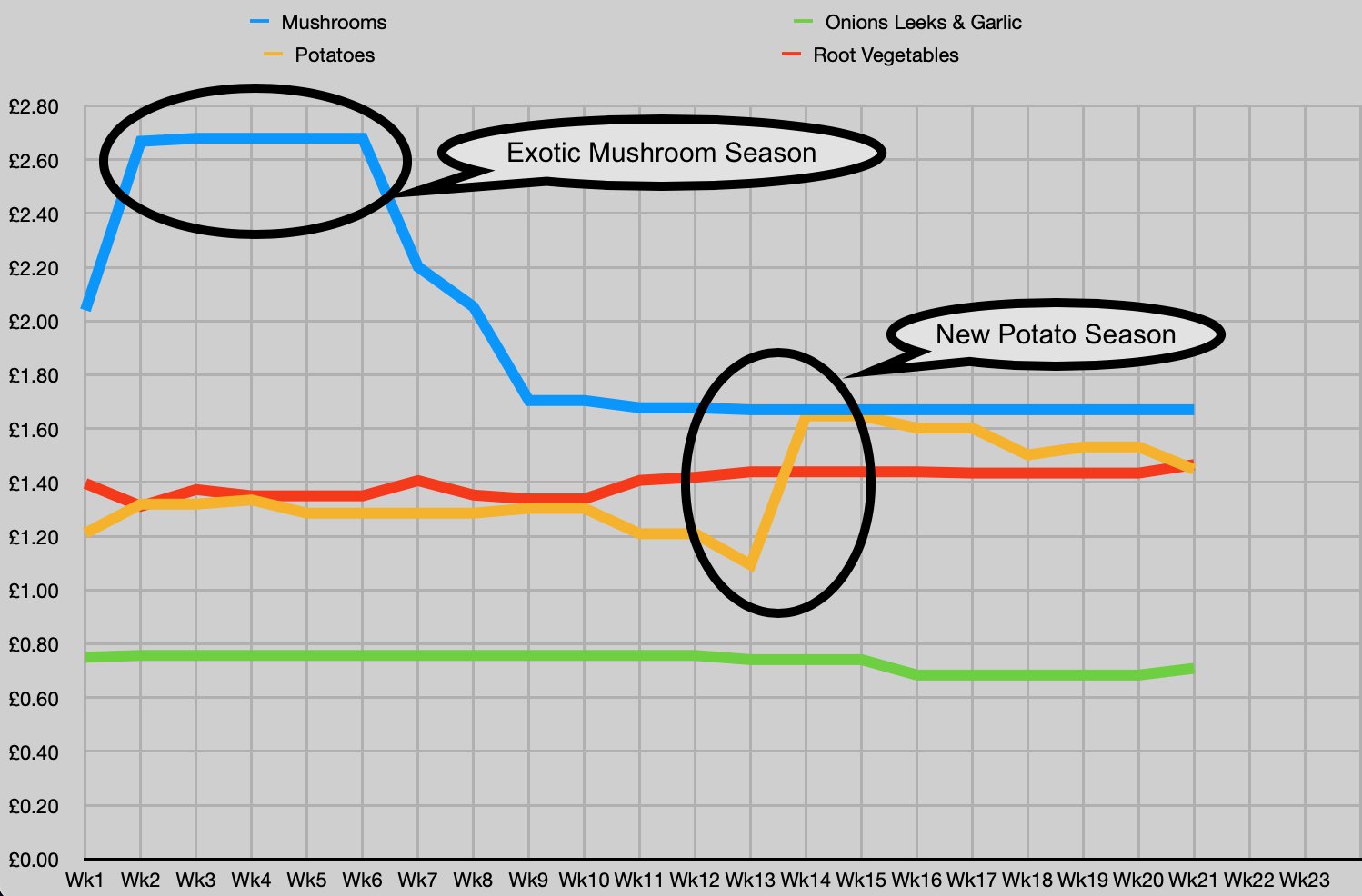

I then split the data into four different graphs based on the type of produce, before plotting the sub-categories on to a chart, starting with with Vegetables, Potatoes and Mushrooms. As you can see from the graph below, any price volatility is caused by high value and/or new season produce.

I then went on to plot the Green and Other Vegetables category. Rises here were again due to the start of the Summer season for English Asparagus. There was also a small amount of volatility in the Squash and Pumpkins sub category, although this was due to the varying sizes through the recorded period.

I then plotted the Fruit category, which tends to be the most volatile in terms of price fluctuations. Again any increases were due to the seasonal changes and import problems. However, due to the mid season abundance of English Rhubarb (Knutsford, specifically), the price of Cooking Fruit has been steadily falling since week nine.

One subcategory which has been very well priced up until this week has been Berries, categorised in Soft Fruit for this chart. Raspberries, Blueberries and Strawberries, which are all usually higher value, have all been products where we’ve been very pleased to pass the savings on.

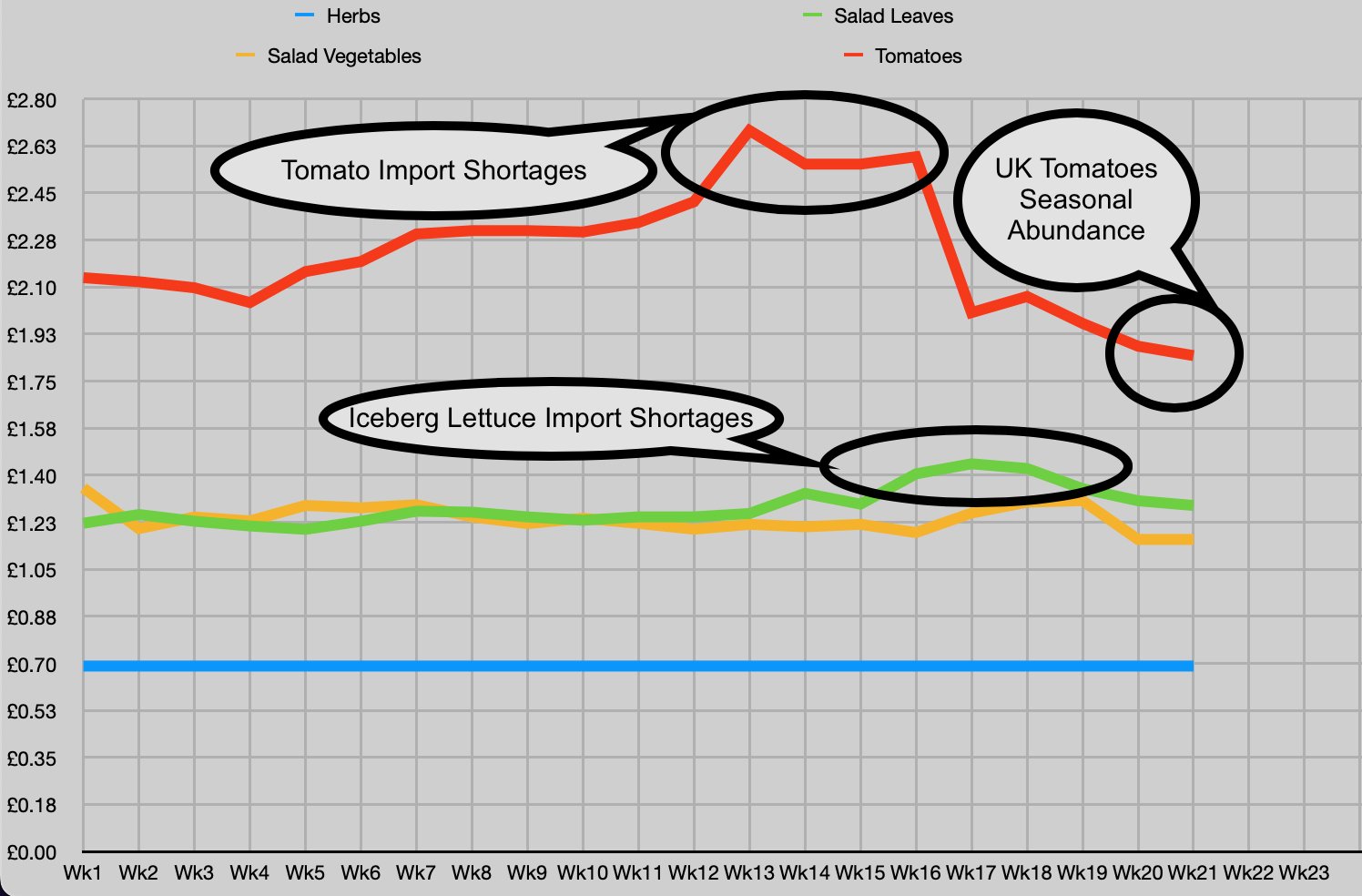

Finally, I plotted the Salad category, which has been subject to extreme volatility over the last couple of months. We’ve had lots of sympathy for the brunch cafes, sandwich shops, hotels and restaurants we supply, as Tomatoes and Iceberg Lettuce hit unprecedented pricing levels, as you can see from the chart below.

Luckily, now the English Tomato season is in full swing, and local varieties of Lettuce such as Webb are available, this shouldn’t be a problem for the next few months.

So I’ll return to the original question: Why have supermarket mushrooms risen in price by 21.4%?

I can only assume that the long and convoluted supply chains used by some food retailers are proving as economically problematic as they are ecologically damaging. In short, the price of fuel and the rise in labour costs have ruined the economic efficiency which previously worked well for their businesses.

Knowing how these supply chains operate has always been troubling from my point of view, and was in fact part of the inspiration to set up HFM. I remember being particularly frustrated by a bread supply chain in a previous role. The bread was produced in the same town as the store where I worked. It was then transported thirty miles to a regional distribution centre, before taking the same route back to the town where it was produced, twenty four hours later. This was all transported in heavy goods vehicles which, when driven well, achieved around seven miles per gallon from the diesel they run on and emit around 950g CO2 per mile.

So what’s the answer?

The solution at HFM has always been to reduce the number of steps in a supply chain. This is something we have been working on since before we opened our doors and are continuously improving on.

We’re very proud to be supporting local growers and are particularly keen to promote the most ecologically supportive farmers and producers, who work with nature to grow the very best tasting crops, without damaging the environment.

We ensure that when there’s a collection of stock required from a local producer, it is planned into a route with other deliveries.

Most importantly, we have eradicated CO2 emissions from our delivery routes, which means no expensive fossil fuels have been used in our vehicles.

In fact, we’re extremely pleased to be a able to report that since the fourteenth week of this year, every single delivery to all customers, as well as collections from local producers have been planned for delivery on either our HFM Cargo Trike or our fully electric Mercedes eVito van.

In summary, we are taking an “EconomoLogical” approach when running our business.

We are using the term above as a fusion of Ecology and Economy, believing that if it works for the environment at a local level, it’s likely to work economically too. It is therefore a Logical approach.

We used to use the term “sustainable”, but feel it has become rather over used by marketing departments, and is now too closely related to the act of sustaining the status quo as it is.

To summarise, our pricing strategy is to aways give the very best value to both our customers and to those we work with. It has never been an attempt to be the cheapest food retailer, as we believe that with that approach there is an unreasonable cost to someone or something somewhere in the supply chain, whether that’s people, nature or the environment.

This means that we have no plans to increase any of our prices outside of the parameters of our pricing strategy.

Importantly, this also means that our veg box subscription prices will also remain at the same level as three years ago, completely unchanged.

I do hope the above has been of interest. If you would like to know any more about how we operate at HFM, just let me know.

Thanks for reading.

Jason

The figures data used for analysis